As a follow-on to a previous article we published for impact investors looking to invest in renewable energy projects, we also wanted to provide guidance specifically for developers looking to apply for infrastructure funding through concessionary or impact focused vehicles. The types of the investors offering impact financing for projects varies from fund managers, banks, foundations, development finance institutions (DFIs), pension funds, insurance companies, and family offices, so it’s important developers understand the unique requirements and impact goals of their investment partner.

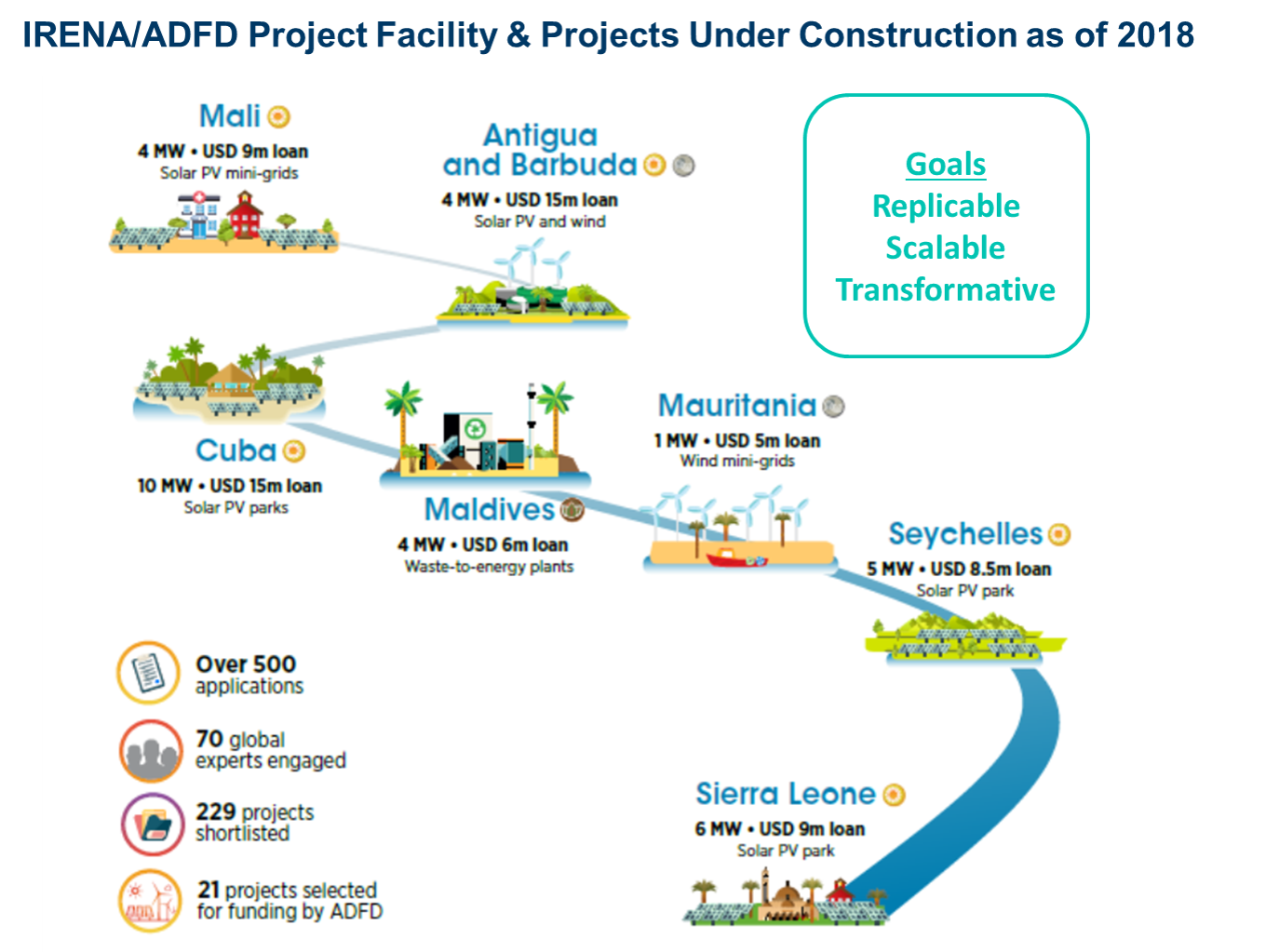

The goals of impact funds often go beyond typical ESG (environmental, social and governance) investments by targeting specific sectors or outcomes that provide additional benefits beyond returns alone. For example, the International Renewable Energy Agency (IRENA) and Abu Dhabi Fund for Development (ADFD) require renewable energy projects to payback a 20 year loan at a low 1-2% interest rate, but also demonstrate positive socio-economic, environmental, or other sustainable development outcome as a result of the project. Understanding the impact goals of the investor beyond the return expectations can help developers design projects that align with these goals and clearly communicate these benefits in their funding applications.

The following guidelines apply specifically for developers applying to funding from a concessionary loan through an institution like a DFI, and are based on our recent work with the IRENA and ADFD project facility as well as previous projects we’ve managed.

Key guidelines for developers applying for infrastructure funding

- Determine what type of financing you need to select the right financing partner. Development of projects can require different types of funding at various stages of the project or technology development cycle. In addition, many investors or DFIs prefer debt over equity or only want to get involved at a stage of the project that corresponds to their risk tolerance and preferred asset class. It may be easier to apply for a grant to demonstrate a new technology while project financing with a low interest loan from a DFI may be more appropriate at the commercialization stage to prove scalability of a new business model.

- Align your project with the financial and impact objectives of the investor wherever possible. Impact investors using concessional loans often have a number of requirements their looking for when deciding whether to fund a project. Usually they state this criteria upfront in application funding material. For example, key requirements of IRENA/ADFD loan include a local government guarantee, technical/economic feasibility, and at least 50% co-financing. In addition, they must have a positive socio-economic, environmental, or other sustainable development impact in their respective country. Therefore, renewable energy projects that meet the financial criteria can differentiate themselves by going beyond just reducing emissions to addressing or other SDG goals like energy access for off-grid communities or poverty alleviation.

- Develop plan that minimizes off-taker risk. Off-taker credibility of the local utility is a recurring challenge in many developing countries. For example, if utilities fail to demonstrate sufficient revenue collection from customers to cover their operational costs then they’re likely to not meet credit worthy criteria of an impact investor. To address this, you may want to apply for project risk mitigation support products available from World Bank Group and other DFIs

(see our previous article on the Scaling Solar Program for more info on these products) to address off-taker risk or demonstrate willingness to pay of a community off-taker through a pilot project. - Apply for funding at the right phase of the project. If the project is being procured through a competitive tender, then don’t expect development capital from DFIs to be readily available to assist with the bidding preparation process. Preferential funding or development capital at this phase of the project often compromises the competitive goals of the auction. Likewise, if your project is already viable with local commercial financing alone, then it’s probably not innovative enough for DFIs that want to crowd-in private sector funding rather than compete with it.

- Clearly communicate your project plan and ensure consistency throughout. While projects in the early planning stage need to be somewhat flexible, applications for funding should provide sufficient detail and avoid inconsistencies. A lot of time goes into developing these documents, so carefully reviewing these documents to make sure figures and messaging is consistent throughout, goes a long way.

- Consider how you can make your project scalable and transformative. There are a lot of projects looking for funding especially from DFIs with access to low interest debt. These DFIs are looking for development and impact returns beyond just ROI, so structuring your project to demonstrate a new business model that can potentially be replicated across the local region or country is likely to be more impactful than a once-off demonstration that’s unlikely to be built again.

While these guidelines focus on developers applying for concessionary loans from a DFI or large infrastructure fund, many of these lessons learned can also be used when working with other impact investors. Hopefully these learnings from past projects will help developers and investors achieve the rapid scale-up of responsible investment required to meet climate change commitments.

Sources: The photo and data on the IRENA/ADFD facility projects status were sourced from IRENA’s website